If you have a PayPal account and find yourself struggling with their plans, fees, TOS, different account types etc then the following points are must read for you. Do check out the money-saving tip in bold.

- There are two types of accounts in PayPal. Personal and Business.

- A single person can only have two accounts with PayPal. One Personal Account and/or a Business Account. Each account should have a unique email address, bank account and credit card associated with it.

- Opening a PayPal account and sending money from a PayPal account is completely free of charge for all account types.

- Receiving funds from a PayPal account:

- To your personal PayPal account is free.

- To your business PayPal account involves fees.

- You can also receive funds from a credit/debit card.

- With personal accounts you can only accept five credit/debit cards payments while in case of business accounts there is no such limit.

- Receiving funds from a credit/debit card to your personal PayPal account involves higher fee than business account. Fee varies by country. Check out fee structure for US based PayPal account holders and fee structure for India based PayPal account holders.

- Business account holders can also accept payment through credit cards without asking the payee to register with PayPal.

- If you have a business account, you cannot accept business funds to your personal accounts. It means you can’t ask your website visitors to put money in your personal account instead of premier/business account. However you can accept funds from your affiliate/advertising network in your personal accounts.

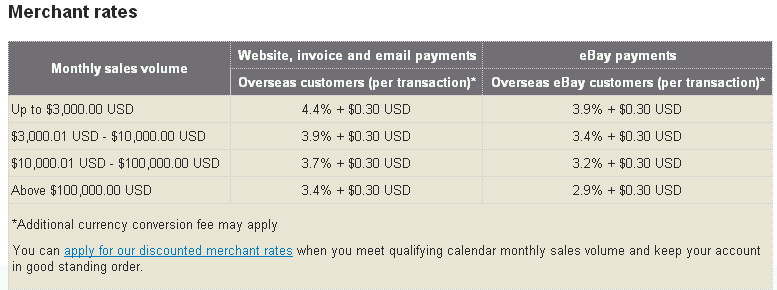

- Money Saving Tip: If you are a business account holder and have a good standing with PayPal you can apply for merchant rates. Merchant rates attracts lower fee than normal premier/business accounts rates. To qualify for merchant rates you should have received more than $3,000.00 USD in PayPal payments in the previous calendar month.

- PayPal has invested a lot on the customer service front. While generic questions can be asked @AskPayPal twitter handle, for account related questions you have the facility to call them or send an email via the contact form.

Don’t let your money stagnate in PayPal account. Invest in PayPal Money market fund and see your money grow.- Something for your protection. Never click a PayPal link in your email. There are lots of phishers around. It is always advisable to directly type-in the URL.

- While opening a PayPal account, use a Gmail address. Gmail has put in place some special authentication for PayPal wherein you will never find a PayPal phishing messages in your Gmail account.

- For simple needs, PayPal also provides an inventory management feature under merchant tools. Now no need to go for those big online shopping carts.

- If you are a merchant and want to find and test out how that PayPal button would behave in real-time. Check out PayPal Sandbox

- If you are a PayPal account holder from outside US be prepared to shell out large sum of money as PayPal fee. Even while withdrawing money(in your currency) to your account, PayPal has its own exchange rate which is always lower than the current exchange rate. I wish PayPal could look into this uneven fee structure. For instance: If you are from India and assume you receive $100 in your account and current normal exchange rate is $1 = Rs 50. The actual amount what you will get in your PayPal account would be $95.8 (3.9% of $100 + $0.3) and if you chose to withdraw to your bank account in India, the amount you will receive would be around Rs 4358 (PayPal exchange rate is Rs1.5 lower than normal exchange rate). All in all a loss of Rs 642 for an amount of $100!

- Make sure you read the T & C document of PayPal carefully. PayPal is quick to limit an account for even a slight aberration. For instance, you are not allowed to log-in to PayPal from a country which is not included on Paypal’s permitted countries list.

- Even if you’re logging in from a permitted country but if that country is not your base country (where you regularly do business from), it’s good to let your PayPal account rep know about your travel plans. I have seen accounts getting limited in such cases too!

Are you an Entrepreneur, a Blogger or someone who do business online. You should check BriefCase by AppSumo BriefCase is like a Netflix of software apps whereby you get 35+ apps at one low monthly or yearly payment. The folks at AppSumo are running a BlackFriday/CyberMonday promotion this week whereby if you subscribe to the yearly account they are offering $100 in AppSumo credits and $50 in Amazon credits. I am already a paying member. I suggest you check out BriefCase by AppSumo. Highly recommended!

If you like these tips and looking for smarter way to work, join me on my new Facebook Group where we discuss Entrepreneurship, Automation and latest apps!

Some readers have inquired about an alternate payment gateway to PayPal.

If you want to process payments in Indian Rupees, just go with InstaMojo. The ease of use, the innovative solutions and their affordable pricing makes them a no-brainer for anyone doing business online in India. Having done plenty of transactions with them over the last year, I have only good words to say about them.

If InstaMojo ever wants to take investments from small businesses, I think I would be the first-one in queue to invest in them. Yes, this is the kind of confidence I have gained with them. All I wish that they keep their helpful support and innovativeness intact with scale.

If you want to process payments in USD, GBP etc, you have a great alternative in the form of Stripe (I envy you guys).

There is another very interesting company that has come up called TransferWise. You can receive and send money to businesses, friends and family all over the world. This is not exactly a payment gateway but they have come up with an interesting concept called Borderless account. You can open an account sitting anywhere in the world. Borderless account behaves as a local account and you are provided your own local bank account number, ABA number etc. It comes with the LOWEST fees available in the market.

In the several thousand transactions that our payment gateways have processed for us, the #1 issue I had was that these payment gateways apply their own exchange rate which is significantly lower than the published market rate. Transferwise solves that problem. You can send and receive money at the real exchange rate. If you receive a $1000 payment in your Indian PayPal account, PayPal will deduct ~$55 as fees and exchange rate. Compare than to Transferwise, it will charge you a modest fee of ~$9 for a $1000 payment. That’s a 6x saving. If you are freelancer or a business who frequently receive payments in USD, GBP or Euro, I strongly suggest you to sign up at TransferWise. (Your first payment upto $625 is free of any transfer charges.) You can thank me later!

Check this list of must have resources we use across our network of business websites.

Ankur Jain is a Software Engineer in Test Automation. After a 5 years stint with Accenture and Oracle, he started his eLearning company. A long-time blogger and proud owner of the "Learn" series of websites.

Ankur Jain is a Software Engineer in Test Automation. After a 5 years stint with Accenture and Oracle, he started his eLearning company. A long-time blogger and proud owner of the "Learn" series of websites.

Paypal exhange rate today is really high, I’m glad payoneer offers lower charges and some are free as well

Can i know if i got 100 euros from italy in to my indian account how much will be deducted as in indian rupee

Hi Sir,

I have personal paypal account and Paypal restricted me to receive payment when i call them. They told me that your yearly payment receive limits exceeded. Can i know how much payment yearly we can receive yearly.

Sir,I don’t have any laptop or desktop.I’m using Nokia Lumia 630 Windows 8.1 phone.My Email is outlook.Since long I have been trying to create an individual account with PayPal but all the time they are not accepting my date of birth.I’m very perturbed.Help me .

Hello Ankur,

Thanks for sharing wonderful information.

Can you please help me to know about following issue.

Client got website from our end, copied script and created a new website and claim in paypal. Now Balance is -870, What if i won’t use this paypal account anymore? Can paypal take legal action in India?

@Aastha: PayPal is one of the very few options available for you if you want to receive USD in a seamless manner. Try to remain clean with them. It’s an issue between you and client not PayPal. Consider this as a bad luck, a part of business and move on.

Hi Ankur,

I started working as a freelance (providing IT consulting services)for past 3-4 months, I have not received a payment yet, generally it comes around CAD-1k to CAD-2k per month.Today I opened an account with paypal( business account).Do I need to open an IT consulting company here in India to get my payments or I can ask my client to make the payment directly via paypal.

@Naga_Navin – PayPal doesn’t allow personal payments in India. However, you can work as a proprietor without the overhead of opening a company.

I have personal paypal account, but from october month i am unable to withdraw money from freelancer.com , So what i can do?

@Priyanak: If you’re from India, upgrade your PayPal account type to business. You are not supposed to take business related payments in personal accounts.

I have a few questions and would appreciate if you can share your thoughts on it.

I am from India. I already have 1 Personal PayPal Account and 1 Premier PayPal Account. Now I want to open a PayPal Account for getting payments for my Private Limited Company.

1. I guess I should open Business Account choosing the Corporation as Company type?

2. Should I close my Premier Account before going for the Business Account though my Business Account will be using the Company Name?

3. Business Account also needs Credit Card for verification?

Thanks in advance.

@Mani:

#1. Yes.

#2. You can either have a premier account or a business account not both.

#3. Yes.

Hello Sir,

I get around 1000 usd in my paypal monthly one user buying virtual goods from my site and after 3 months 30 transaction he gave chargback to me of 3200 usd (2 Lakhs)

Now i am gonna loose the case (according to my google searches and all reviews)

i made my connected bank account balance NULL and i never attached credit card with it only my personal information that they have …

Now My Question is can they do any harm to me.. if i just go disappeare

Cant Get Proper Answer from anyone .. Please help me as soon as possible awaiting for your reply

Thanks In Advance

@Purav: All I can say is to be safe with PayPal. Tell them your concerns and see if they can help you.

I made a donate button for my project and registrd my card. But when I asked my friend to check if that works …he couldn t make transaction to my accounut…aldo we made everything…must I wait few days for account to be active…I did activation yestreday..08.09.2027

Hi! This article is very well written and informative, thank you!

I have been trying to gather information on Paypal, since I’m going to start as a freelancer very soon and I need some advice.

I will be mainly working with companies paying in USD, I live in Europe and as such I have EUR currency, and I wanted to ask: is it true that the PayPal exchange rate is usually lower than the bank’s? I have found different sources stating different things on that topic and I’m confused. Since I know that there is the possibility of adding another currency to the account, I was thinking of adding USD and keeping the payments in USD, instead of having the money changed to EUR at every payment, and then I would transfer the the USD balance into the EUR balance every $300 or so, to maybe pay less in exchange rates – if that actually makes sense.

Is it possible, that you know of?

Or, is it possible to transfer the USD directly to my (EUR) bank account?

Which one of those would be the cheaper possibility?

Or, is there anything else I can do to reduce at least somewhat the exchange fee?

I have a private verified PayPal account, and I will be receiving payments from other PP accounts mainly; as such, the payment fees shouldn’t be a concern to me, but the exchange isn’t really favourable at the moment and I’m trying to limit my losses there. Any idea?

Thank you in advance ! 🙂

@Valentine: In fact that is the case for all merchants. It is done to prevent losses in currency fluctuation.

ankur ji my family asked me for paypal and i made them answered but they asked is the paypal real?isnt fake it is? I m not sure about it plz contact me and make me sure about it and telll me about that packet kit in which the information how to work on paypal is given and the packet kit having the info how will the money reach in my bank account? Will it reach or not?

@Gaurav: I am not sure which ‘packet kit’ you are talking about.

Hi, the reason for me sending money is because of my brother he lost his money and i plan to send him alittle money 35$ he is in turkey how much do u think money will he receive? And do u think paypal will ask me to pay for money transfer fee. Im here in philipines and my brother is in turkey pls answer thank u.

@rica: Check your country’s fee in PayPal.

I have no paypal acount. I want to send money to other country.Is there any authorised person or service who can do this for me through paypal..?

If you are in India, you can open a PayPal account for yourself. It’s quick.

Hello, i have a business account opened at PayPal

I see that I can withdraw maxim 2500 euro per year

I want to make business for 50-70.000 euro per month and to withdraw this money in my company bank account

I want to ask you because I see that you have a lot of knowloge about PayPal rules

Can I withdraw this money each month like 50.000 euro to company bank account

And what are the commissions ?

Thank you very much !

@Dante: Do you have some restrictions in your PayPal account? Ideally it is unlimited, once you go through their verification process. The rules are country specific. Check yours!

I want to open a business account with paypal, when I gave the business PAN, it says it is invalid . I am not supposed to give a personal PAN, because this is a business account (am I right?) when I open and login to my account on paypal, it says welcome and “my name” so I believe I should give my personal PAN and not company PAN to verify.

The company is a partnership, so it wouldn’t be right to give just my PAN

What should I do here??

Hello All,

I am a seller on paypal.

Paypal is highly unprofessional, unethical in dealings.

They can hold your money without any reasons for an indefinite period.

I have been experiencing this since Dec and having very tough time.

As some one pointed out rightly, they always side buyers not sellers.

Be aware.

Sir…what is purpose code in paypal .what i chose in all options

hey I am a student and a freelancer too, so i need to open a paypal account to receive payment from 3 website so which account should i go for?? and also which purpose code should i opt according to Indian Rule??pls help…

@Anurag: You should go for premier account.

Excellent Article Ankur. It’s still current after 5 years. I have a question you might know the answer to. I’m living in Canada and have had a personal PP acct for over 6 years in perfect standing. However, since opening my account in 2008, my credit rating has become terrible. Also, I would like to upgrade with PP to their “Advanced Business Account.” I spoke with a PP customer service on Feb 25, 2014, and learned this will cost me $5 monthly plus transaction fees. So far so good. However, I’m very worried that they may decide to run a credit check on me personally to make sure that I’m “low-risk” in their eyes. If they do this, they will discover my credit rating is very bad. Can you let me and others know if you have heard of PP running credit checks when their members upgrade to either an “Advanced or Pro” business account? By the way, in their TOS, they claim that they have the right to do this, which is what has me very nervous. All help and advice is appreciated. Thx Ankur. Tammy.

@Tammy: If their TOS says so, yes you should be careful.

Are you sure you need the Advanced Account? Do check their normal business account as well. It has all the facilities of personal account and more and transaction fees are much lower.

Dear Sir

I want send the money to china by using paypal. Please tell me the methods.

I am using HDFC and AXIS bank debit card. How i should open the account and and how i can transfer the amount to my trader at china.

Kishan

@Kishan: If you want to create a PayPal account from India, you would need a credit card to send money. Debit card won’t work. You can also Wire transfer the money. Check with your bank.

Hello

We have recently started using PayPal for our Ecommerce venture in which we sell goods to Indians abroad. Since we cannot hold the dollars in Papal account, we often use the existing PayPal balance to refund those customers whose orders we cannot fulfill.

This practice ccauses either some loss or profit due to dollar fluctuations. I would like to know if you have any recommendations on managing accounts (book keeping) with respect to PayPal transactions. How to adjust the profit or loss whi ch results due to dollar fluctuations.

My question may sound naive. But I am not for Accounts background & hence looking for some help from experts.

@Nitin: Your CA can certainly help you with this. Losses/Profits arising out of exchange rate fluctuations can be shown in your accounts.

Hi

I want to make a personal account on paypal but i don’t ve a pan card.

Do i ve to make the account on my dad’s name if m using his pan card or i can use my name with same pan card for making an account ?

@Meenakshi: If you are using your dad’s PAN card, use his name.

Hey fren, i have problem with paypal. im new user coz coz i need to receive money from my buyyer oversea (other country) i sell my item just $420 than my buyyer said he was send money to my paypal account and paypal send me email to tell me they already deduct $420 from he (buyyer) and just wait for me send the proved (recipt/post t.t number) for verification. After all it done, paypay reply me back my transaction will realise to my accout in 12-24 hours without login until get email from them. Im waiting until 3 days and they said ‘account limitation’ min transaction is $2000. so they deduct agains the balance from my buyyur to reach $2000 and to make all this clear paypay ask me to refund back the balance using western union ($2000-$420* = $1580*) and send to them back the western union receipt for verification to they proceed all the money to my account. After i research about paypay im scared and not trust to give my money ( refund/$1580)to buyyer if im late to done this refund, my money are hagging there and will freeze. Is it true about this paypal procedur and what should i do ? If this true, maybe my paypal account will get limitation also and cannot witdraw all the money back. Please help me, reply asap…

i received $ 0.48 in my paypal account from a PTC site. Deducted fee is $ 0.32. is it a very high percentage of fee deducted by paypal?

Beware of PTC sites. PayPal frown upon such sites.

Can i use paypal for my online technical support business in india.

@Rahul: Someone paying in INR to Indian Paypal account – No. Otherwise Yes.

I opened a premier paypal account . It charged me Rs. 63.19 . And I am worried that should it continue for next month also ? I mean pls tell me I would be charged for next month also or It would be free for next coming months ?

Hoping for your early reply !

Thanks

Just read shiva’s comment! I was just going to upgrade to premier a/c.. now, on 2nd thoughts..

Guys, plz let know if they r charging on paypal premier a/cs..

waiting feedback!

thnx

Hey I have created a PAYPAL PESONAL ACCOUNT!

And I’ve Confirmed my BANK ACCOUNT.. N LINKED IT WITH PAYPAL….

BUT THERE IS A OPTION THAT ASKS FOR PAN INFORMATION….. IS THAT REALLY REQUIRED TO CONFIRM THE ACCOUNT….

NOTE: I’ve verified my bank ACCOUNT!

Is Pan Important for it….

will I be able to receive and send payments ?????

#imHBN

Yes, if you’re in India, you need a PAN number to withdraw money. It is very easy to apply for a PAN card. You should be able to get it in a week.

I just did google search on paypal reversal scam. This was first listing and it was right on the nose correct. Ebay/Paypal must be stopped by someone. Author is correct I just had someone with no history buy an item in November and shipped two days later. Got message just today the funds were reversed with NO explanation. Can’t wait to get the negative feedback which I have no control over either since 1 out of 20 people actually give feedback after buying.

Don’t do international whatsoever after a Canadian/Paypal scam cost me $200 – no tracking by USPS across US border. Already had plenty of buyer scammers trying and sometimes getting refunds/discount and switching products out when returning. Don’t need Ebay/Paypal helping them out.

This time I am not going to lie down and take it. I have already researched the buyers name! Luckily they used their work email and I will also contact their workplace! I eventually will file a police report on this buyer and federal charge of wire and mail fraud. Thanks internet for evading everyone’s privacy and I will do the same when I am wronged.

You can do this too!!! Go after the address you mailed it to!

@Grace: That’s the harsh reality we have to accept. Do let us know about the progress in this case. All the best!

Dear Friend,

Very useful info! When I opened personal a/c in 2007,that time no such clear & useful info was available for indian users.I gets some money from affiliate type program & some matrix type programs where user sends money thro’ his paypal a/c by entering his sponsor’s paypal email .

As some sellers affiliate programs only pay to affiliates only if an affiliate have premire a/c. So I want to open premire a/c. At this time ,there is no option in my paypal a/c to upgrade to premire. Paypal representative says that personal a/c is same as premire & I should close this current personal a/c & then open new premire a/c.

Plz give me advice that should I keep this current verified personal a/c & open a new premire a/c with different email & debit card ? I have attached ICICI banks card to my current active personal a/c. Debit cards from which other banks are perfect to attach if I opens a new a/c?

With premire a/c ,Can I eligible to receive payment from my site visitors & other programs downline members(From worldwide) when they simply login their paypal a/c ,enters my paypal email in the ‘send money to’ option & clicks on ‘send money’? Currently I gets money in my personal a/c from such member.

Plz reply me as early as possible! I will be very thankful if you send a reply to my email.

Thanks again!

Pravin

P.S. I request you to update this article if possible!

@Pravin: We have updated the article with latest info. Check the top link regarding Personal vs Premier vs Business, so it is indeed possible to open a Premier account with them. Make sure to use different address while opening such an account.

i hv registered myself wid paypal, and they charge dollar one from my account.. i cudnt understand the fee.. is the registration chargeable?? are thr any hidden charges tht would be deducted afterwards?? what if i nvr use my paypal account i mean if nvr such need arises?? pls reply..

No, the registration is not chargeable. That was done to verify your credit card. You should not worry about any extra charges with PayPal. In my experience they are quite transparent.

Hi Ankur,

Thanks for your post, i will like to tell you that for withdrawing funds to your local bank from your paypal account is free ( Ref: https://www.paypal.com/us/webapps/helpcenter/helphub/article/?solutionId=11927&topicID=11500006&m=HTQ )

Please update this info. and also the calculations you have made with new dollar rate-lol.

Thanks,

Robin

Yes, it is free I never said withdrawal from Paypal is paid.

Hey,

Nice article was very informative. I have a question though,Please help me.

I’m a freelance graphic designer and I have a personal Paypal account were I want to create a “Buy Now” button to sell my designs , Is it possible for me to do it?

As I’m freelance is it possible for me to start a business account with the same details and bank account I have used in my personal account?

I’m really confused and Thanks.

-Gautham

You can go for Premier account, if you are not a registered entity.

while creating business paypal account in india it is asking for business details, business owner details and PAN number is it for the business or business owner (PAN Details). it is not clear

If you’re registering as a business, provide your business PAN details.

HI my case is similar to Yogi Amitram but i serve old people,can u give your contact details?please.if not please answer my question,why paypal takes credit card,do they take money on monthly/annual basis without our approval? Is there any hidden charges ?. why not debit card?Please bro answer my questions

hey, i want to make account on paypal , but paypal is not currently avaible in pakistan ,i want to start from saudia arbiya so by cosing saudia arbia can i use my pakistan credit card ?

@qasim: Please check with PayPal support regarding this. I may have said this earlier and will repeat, please be careful with PayPal. They are quick to limit accounts if they found even an iota of doubt. Better be safe than sorry.

Hi,

First of all a very informative article and I must congratulate you for it. I am running a business in India wherein I want to start selling aquarium products online using PayPal. However, my customers would only be from India. I tried a lot to find out the fees structure for these transactions where they will be only within India and nothing coming in from out of India. However, I am not able to locate this information. Do you have any idea about the fees structure for such case? I would open a Business Account based on the fees that are charged. 🙂

Hi all,

I dont have pan card . can i use my mom’s pan card?wll it be a problem in future?

Thank you very much for an excellent information.

Dear Akur ji,

I am running a small ashram, and i want to receive donations from India and other country.

Our ashram is in the beginning situation. so we can not afford a lot of expenses.

Please guide us , what to do also please e-mail me you contect no. I would like to talk to you.

Namaste

@Yogi: I have sent you my contact details.

Dear Friend ! I have not Credit Card , and i want open account on Paypal . So please advise me , it is possible to open account on Paypal without credit cart and how can i open …………..

I think you should update the info on this blog article. Paypal is now offering only two types of accounts now. And the fee structure has been revised somewhat.

Yes Akshay. It’s a bit dated article but still most of the part is relevant today. I’ll try to update the outdated points.

can i open a personal paypal account using my sister’s pan card since i don’t have a pan card yet. Her pan card is not registered to paypal. Thank you.

@Marsanen – Why not, just that any earnings will be credited in her account not yours.

i want to make paypal acc for business.i am from india and do business with us cust.can u tell me for which account should i go.and what are the requirements for dat

@Salman: Go for PayPal business account.

Sir i just open a paypal account several days ago with my name.

The detailed bank account given is a joint holding with my father and the name on the debit card is my fathers name but pan no is mine they say the pan is invalid.if i give my fathers name is there is a chance or not

Hey!

Excellent post!

I just wanted to know whether it is possible to list an Indian debit card and transfer money overseas.

I tried listing local debits, it won’t accept. Is there a way to pay international sellers, like those on eBay via a personal PayPal account?

Thanks!

@Frank: I think only credit cards are allowed not debit cards. Personal accounts have many restrictions, I would suggest upgrading to premier/business accounts.

My name is Arvind Kuliyal but as per records it is only Arvind, so when I was opening my account I wrote Arvind Kuliyal but later on i came to know about the procedure for Pan Verification. I want to change the name to Arvind to my account. How can I do that.

Hello Dear,

My Brother wants to open a Paypal Account In South Africa and we will work for U S A customers from INDIA . We are going to start Online Technical Support for Computers For U S A customers .

Can my brother attach his salary account in South Africa with Paypal account to receive money from U S customers..

Please Advice

Thanks

Varun Dawar

PayPal is available in South Africa so I don’t think there should be any issue attaching PP account to receive money.

Great post friend,

Keep it up…

Hey Dude,

Awesome blog post.

In your 9th point,

“However you can accept funds from your affiliate/advertising network in your personal accounts.”

Are you sure of this?

I m going to start a closed network of advertising club, where in members get additional features if they pay.

Do I have to register under the Ministry of Corporate Affairs? I do have DIN.

Can I receive funds from members, into my personal account in paypal?

Or Shall I upgrade to premier ?

Do i have any problems from IT dept ?

Paypal have destroyed my business before it got up and running, screwed my 2 ebay powerseller accounts up,our 1st holiday me my wife and 2 children were having in 3 years has been cancelled all because of the limitation rules and the fact they hold on to your money for 90 days always side with the buyer i could go on and on and on but to be honest i just wanted to warn any business going with paypal HAVE A BACK UP PLAN!!!!!!!!!!!!!!!!!!!

Gr8 Information Friend,

You have a good knowledge for Paypal Accounts.

Thanks

Really liked your post. You seems to know a lot about PayPal, Kindly help me.

I have heard PayPal demand lots of documents for Business Account. Could you tel me something about what documents they ask. I have a unregistered Individual Small Business in India which I operate from home. I do have Bank Account with Business Name, PAN Card on my name, Company Stamp, letterhead. What else to PayPal Demands.

Also I have read several places to open a premier account with Business Name eg If your Business name is Acme Solutions type Acme in First name and Solutions in Last name of Premier Signup. Article says this is trick for people with very small business. I would like to know Is it Legal to do that or PayPal is gonna freeze my account.

I tried contacting PayPal but their support really sucks.

Thanks.

@Mayank: Thanks for your kind words!

I do have Bank Account with Business Name, PAN Card on my name, Company Stamp, letterhead. What else to PayPal Demands.

I think that should be sufficient. You can check the PayPal help for the list of all required documents.

Article says this is trick for people with very small business.

I would suggest you not to take chances with PayPal. They are quick in limiting accounts and after that it’s a real long drawn process to deal with them. So better-safe-than-sorry.

All the best!

Boss, How can I thank you ? I have just registered with paypal and just wanter to know more about and landed in your website. never seen such an info loaded web page in my life. Thanks allllott.

Janardhan: Thanks for your comment.

Hi

I like to open an account at PayPal. But since I do not have any credit card, I am not able to open an account in PayPal. So, there is any method to open an account in PayPal without the Credit Card? pls let me know

Thanking you

anup kumar

@Anup: You can open a PayPal account without a credit card.

Credit Card is only required when you want to become a ‘verified’ account holder.

Yeah mate PayPal makes money mainly from us mate…

That’s a great piece of info mate…

Thanks

@Balaji: Glad you liked it