Since June 1st, 2013, Indian Income Tax dept. has made mandatory to deduct 1% TDS if the property you are buying is more than  50 Lakhs. I see there is a lot of confusion amongst people regarding how and what to fill in the various fields provided in the form of Tax Information Network (TIN) website.

50 Lakhs. I see there is a lot of confusion amongst people regarding how and what to fill in the various fields provided in the form of Tax Information Network (TIN) website.

Some points before we start

- The online form available on the TIN website for furnishing information regarding TDS on property is termed as Form 26QB. It has been specifically introduced for deducting TDS on property purchase.

- According to rules in respect of tax deducted at source, buyer of the property would have to deduct the TDS and deposit the same in Government treasury.

- Buyer or Purchaser of the property is NOT required to procure Tax Deduction Account Number (TAN). The Buyer is required quote his or her PAN and sellers PAN.

- Frequently Asked Question: If amount of property sold is

70 Lakhs, would TDS be calculated at

70 Lakhs, would TDS be calculated at  20 Lakhs or on

20 Lakhs or on  70 Lakhs? TDS is to be deducted on the amount paid/credited to the seller. In this case, the deduction will be on total amount i.e. on

70 Lakhs? TDS is to be deducted on the amount paid/credited to the seller. In this case, the deduction will be on total amount i.e. on  70 Lakhs.

70 Lakhs. - TDS would be calculated on the total value and not just the BSP i.e. you have to include EDC/IDC, parking, service tax.

Here is the step-by-step complete process from filling Form 26QB to downloading Form 16B from Traces website.

Navigating to IT website

Go to e-payment page of Income Tax department and click on Form 26QB hyperlink.

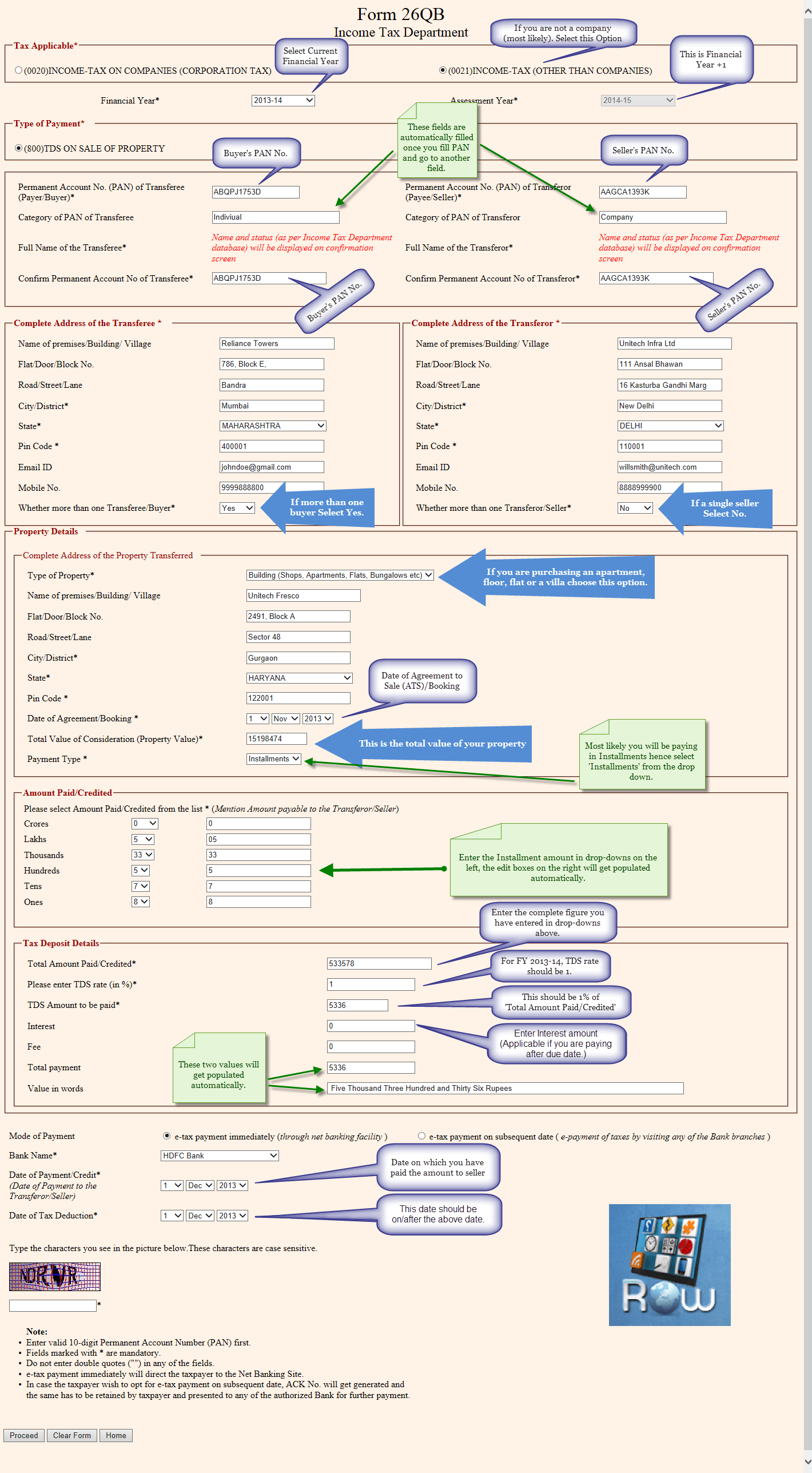

Filling the form 26QB

Now before we move ahead, you need to understand this part clearly.

If the property you are purchasing will be in the name of a single buyer and it is sold by a single seller, your life is just made easier. On the form shown below, you would need to fill No for both fields Whether more than one Transferee/Buyer* and Whether more than one Transferor/Seller*

If not, don’t fret. We will make sure the process is smooth for you. Online statement cum Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. For example: in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares.

In the process below, we will take the common case of two buyers and one seller hence you would need to fill (2*1) two forms. (You can click below to view enlarged image) Fill in your details as shown in sample below.

Once you click on ‘Proceed’ above, you should get ‘Confirm Data Page’ (if you have filled the form without any errors). Go through this page to cross-verify your inputs. Scroll down and click on ‘Confirm’ button.

On the next page, you will get Acknowledgement number. Make a note of this number and save it in a safe location since it would be needed later to download form 16B.

Scroll down, hit ‘Submit to the bank’ and make the payment. Make a note of the Challan number you see on the last screen. This will be needed for Traces registration below.

Downloading Form 16B from Traces

After you get the acknowledgment number above, wait for 4-7 days. Now go to Traces website and register as a new user (if you have not registered yourself earlier) by entering your Validation details and details required under Option 2.

If everything has gone well, you should see the screen below.

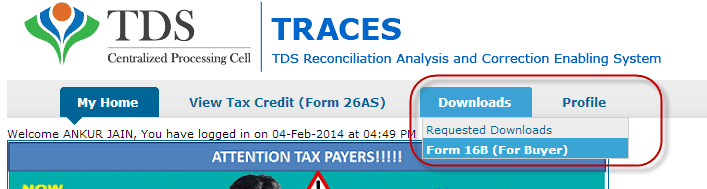

[Go to Downloads > Form 16B (For buyer)] Fill in the required details on the next page and you should be able to download the form 16B within 15-30 minutes.

That’s it. Enjoy!

I use this software to semi-automate the process of filling up forms. This is an inexpensive software which has saved me several hours of time over the past years.

*Some people report that various income tax websites are inaccessible from outside India. In such a case you can make use of a proxy service. Such services can make the web server of a website appear as if you are coming from a particular country (of your choice). (In our case, just select one of the Indian servers when you register and logon to such a service)

Please go through all the comments. In all probability, your question(s) may have been answered already in the comments section below. Since the questions are getting repeated, we are closing the comments section for new ones.

Ankur Jain is a Software Engineer in Test Automation. After a 5 years stint with Accenture and Oracle, he started his eLearning company. A long-time blogger and proud owner of the "Learn" series of websites.

Ankur Jain is a Software Engineer in Test Automation. After a 5 years stint with Accenture and Oracle, he started his eLearning company. A long-time blogger and proud owner of the "Learn" series of websites.

Hi Ankur,

Thanks for sharing info related to this property tax as not much info is available on this new rule set by Govt.

I purchased a flat for Rs 70 lakh in Feb 2014 and have filled property tax of RS 70000 at that time. Rest 69.3 lakh payment was made to seller. Seler has further invested this amount for some flat purchase.

Now, my 26AS shows a tax deducted of Rs 70000 and but seller’s 26AS does not reflect this amount. Though earlier when I checked on few websites, it showed that this amount will be reflected in seller’s 26AS.

Now, what is the way out to claim this refund as ideally it should be claimed by seller?

If I claim it and give it to seller, will there be any issue?

Hi Ankur,

Very useful article. One clarification required though. If a builder quotes total cost of the property as 1crore, if I am taking care of TDS, then does it mean that the total expense I have to bear is 1.1 crore or does it mean that the actual effective money the builder gets is 90L.

Right ank has disbursed an installment to builder as

after deducting TDS, and has asked me to make the tax payment.

Sujit

Dear Mr. Ankur

I really appreciate the solutions provided by you on various matters relating to 194IA cases.

I have one question relating to one of my client.

My client has deducted 1% TDS on property purchase transaction but while making payment of it wrongly inserted A.Y. 2014-15 instead of 2015-16 however other details relating to property purchase transactions are absolutely correct.

He has only entered wrong Assessment Year while making online payment.

Now his 26AS forms reflects such deduction but under wrong Assessment Year

What is the solution available in this case?

Kindly suggest how to correct such mistake.

Awaiting for your valuable suggestion.

Thanking You

Regards

Chirag

Hi Ankur,

I am NRI & recently sold a property for INR 57 lakhs on Feb 17th 2014 and TDS is paid by my buyer of amount of Rs.57000 after deduction in considerable sale amount.

& TDS receipt is handed over back to me.

Sale amount breaks up.

Total considerable sale cost:57lakh

Paid back to bank: 17.5 laks to close home loan.

Paid to broker: 57000

Amount received by me :38.5 lakh as on 17 Feb 2014

Total EMI paid to Bank: 16.44 from march 2008 till jan 2014.

As Above property was bought for Rs.33.25 Lakhs in August 2006 in which I took 22 lakh from Bank as a home loan & balance amount paid by me from my NRE account.

In Nov 2013, I have booked a flat of total cost of Rs 1.3cr which is under prelaunch stage and 25%of payment is paid to builder in installments till June 2014.

I am a NRI kindle advice me how to file & claim TDS return of a tax credit of INR 57000/-.

Is there any Capital gains Tax liability would be since I bought new prelaunch property of Rs.1.3 cr.?

Thanks for advice & help.

Regards,

Raj Gupta

Hi Ankur,

Thanks for writing such an informative article although there are quite a few articles on this topic on the web I found yours to be the most comprehensive. I have the following queries:

Case I

My parents purchased a property from a builder where my mother is the first buyer and my father is the co-owner. The property is sill being constructed and the possession is yet to be handed over. They paid two instalments of Rs. 19,24,063 in July 2013 and Rs. 19,50,191 in August 2013 though a joint account of my parents. TDS was deducted from both these instalments however since my parents don’t have an online account I paid the TDS amounts from my account. Also since we were not aware on the need of filling separate form 26B we filed a single form 26B quoting my mother’s (1st owner’s) PAN. Now my queries are:

a) What can we do to correct the situation above?

b) Also while filing ITR for my mother I notice that the TDS deduction is being shown as Advance tax even though in the form 26AS the TDS payment is coming correctly at “PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property)” under Form 26AS on Traces. I have also downloaded Form 16B and my mother’s name comes under transferee and the builder’s name comes under transferor which is correct as per our understanding. What may be the issue here?

CASE B

Me and my wife have purchased a flat where she is the first owner and I am the co-owner. We have taken a home loan from Axis bank. Axis bank has made 3 payments in 2013 (after 1st June 2013) but they have deducted tds from only the third payment. When we contacted Axis bank they told us that since they were not aware of the rules at that time we should pay the tds on the other two payments and then they’ll “refinance” us the same amount. I have the following queries:

a) What is the amount we should pay. Will that be 50% of tds amount + 1% interest per month from the date of payment from both me and my wife’s account?

b) What should we fill in FY and AY fields of form 26B?

Thanks in advance for your time and my apologies for the long queries.

regards

Devesh

Dear Ankur!

I am buying a flat which has 2 owners (Mother and Son) for 80Lacs. I am advised to pay TDS online for both of them in this way:- Make a payment of 40k on Mother’s name and similarly make a payment of 40k on Son’s name.

I am doing it first time, hence need your advise to do it correct. Pls. confirm if the above process is the correct way of doing this and also, while filling the form for Mother, i need to mention the total cost of the Flat as 80Lacs and deduction is 1% then just make a payment of 40k, is it fine and system will allow me to make a payment of 40k thought 1% is 80k and similarly, i will do it for the Son as well.

Appreciate your time and advise on the same.

@Ashish: Please check the blog post above carefully. All your answers are hidden there!

Hi,

First and foremost, this blog is highly educative and interactive, which is very commendable. 🙂

One of the concerns, I am facing is: while paying the TDS online, while i was redirected to netbanking, under details of payment, I chose “Others” which is clearly reflecting in the challan. Now the Form 16B downloaded from traces, has the said amount, but under a different section, and it is not reflecting in the developer’s 26 AS.

Can this be rectified online? If yes, then how?

Hi Ankur,

I want to pay 1% TDS for the property which has 3 owners listed in sale deed.

However, only one person is making 100% payment.

I have already made 5 payments after june2013 spanning two financial years but no TDS paid so far.

What is the least # of 26QB that can be filled to pay all TDS including interest.

if 26QB is to be filled for owners not making any payment, then should the amount paid/interest be listed as zero?

Thanks for your help and hope to hear from you.

if More than one Seller, and one Buyer and total amount 85 lack (54200+30800). what Should we do to fill 26QB.

Please Suggest us as earlier.

thanks

Hi…I have bought a house above Rs 50 lacs and paid TDS withiin 15 days and have already issued form 16B to seller…Now while filling income tax returns this amount is appearing in my TDS list in 26as and on calculation on payable tax it shows a net refund of same amount…

is this how it is supposed to be? Am I supposed to get a refund of this TDS?

@No. Why would buyer get a refund?

Hi ,

i have peculiar problem. bought property for 75 lacs from one family – 4 members. 75 k due as tds. i gave pan number of sellers to bank for filling form 26qb. iam filing return this week. on logging into tax website that 75k is shown as my advance tax . i went to bank, they showed form 26qb uploaded to website.buyer and seller details are correct. but in challan payee name and pan number shown is MINE. they say challan is generated by system and no date entry involved from their side. is it bank problem or tax website problem. how to solve this .

Hi Ankur,

Please accept my sincere appreciation for providing some valuable information on the website. I appreciate it further if you could kindly provide me the clarification for the following question.

My wife and I are NRIs. We booked an apartment with a builder for about 65 lakhs in down payment option in 2009. We made 95% payment (about 50 lakhs) to builder in 2009. In March 2014 we paid the remaining amount. My query is whether we need pay TDS for the entire amount (65 lakhs) or only for the amount we paid in 2014.

@Palani: Thanks. This question has been answered earlier as well. You need to pay TDS on entire amount.

Dear Sir,

I have paid 2 installment to builder without deducting TDs,in financial year 2013-14 and now I a m deducting and depositing TDS in this financial year 2014-15. What should be financial year to be selected in form 26QB .Pl help me.

regards

My client have filed Form 26QB and paid challan. After perusal of the same I noticed that assessment year was mentioned/selected was 2015-16 instead of 2014-15.

How can I change/rectify the assessment year in Form 26QB?

Pls Guide

Hello Ankur

I appreciate your time and efforts to guide people . I will appreciate if you can clarify the following

a) I am an NRI and just bought a property for Rs 1,34,2900 based on BSP and additional chargers for car park, club and lots of ther misc charges around Rs 18 lacs. 1% TDS has to be paid on BSP amount of Rs 1,34,29,000 correct

b) Property is in my wife’s name and I am the second applicant. We have a joint account ( NRO / NRE) does she has to file 1% TDS using her PAN Card or I can pay on her behalf using my PAN Card

c) installments we are paying is bps plus Service tax ( example installment Rs 100,000 plus service tax Rs 3708) so total cheque amount is Rs 103,708 and while filling the form under cheque amount column do I mention cheque amount Rs 100,000 or Rs 103,708 as 1% TDS

d) For last installment Of Rs 10 lacs I did two RTGS transfer of Rs 5 lacs each in that case I have to fill two forms or one

I know these are basic questions but it’s the first time I am filling return on line and will appreciate your feedback

Thanks

Arun

Here is my scenario. I had 95% of my flat value paid before they introduced TDS. Only 2L was pending after TDS came into being. What should be my TDS amount.

@Sudeep: TDS will be calculated on full consideration amount.

Hello Sir,

I had bought under construction property in joint name with my wife as first holder.(Registration still not done). We both are salaried.

Now I had two question

1- We had paid first installment Rs 9 lakh from my wife`s account & 5 lakh from my account now I will have to fill two form & pay TDS in a proportionate amount but inform me in agreement value amount has to be entered full in both form or it should be as per share.

2- We are planning next installment from MY wife’s account only than at that time should i fill one form only or two form (my form with zero payment).

Dear Ankur.

Query here.

If Buyer is non resident Indian(i.e Canadian Resident). He is liable to Deduct tds or not.

if yes, then what’s the Excess Requirement from here.

please reply

Thanks a lot Ankur for sharing this information. I need to confirm few queries :

1 . We are 2 Buyers buying property from 2 Sellers. The instalments will be done from my husband’s account. This property costs for 68L, So do we have to create 4 forms with 34L per form? and TDS paid will be 3400?

2. As this is resale flat, can we pay whole TDS i.e. 68K in one go?

3. How many days will it take to get the receipt for the same?

4. Should it be paid before any agreement?

Please help to know.

Thanks,

Hi,

I have purchased a property in the month of May’2014 and made subsequent installments in the month of May and June. However TDS has been deducted only during the last payment in the month of June. I would like to know whether any interest shall be applicable if the TDS is being deposited in the month of July. If so then on which payments shall the interest be applicable for.

Also will penalty be attracted for this TDS deposit. As far as i understand Form 26QB is in itself a challan cum return. Hence no further return needs to be filed. Thus will penalty become applicable if I fill this form in July or shall it be considered to be filed within due date (as due date is 15 July for June Quarter End)

Hi,

I am purchasing a flat from joint owners(wife and husband) in which wife’s name appears first on share certificate.

Sellers are insisting to make the payment and deduct the TDS only on Husbands name which is second in share certificate.

Kindly advice, whether cheques can be given on single name and TDS also can be deposited on single name?

Weather there will be any issue with IT?

Regards,

Pradip

Hi,

we have made TDS for the property that we are buying. Just before registration, we got to know that there are 2 sellers and we had made TDS on behalf of one seller. Is there any way, we can claim the TDS that we have made and do a new TDS on behalf of two sellers all over again? Any help on this matter will be appreciated since its an urgent situation. Thanks.

Hello,

I have bought the ready possession Flat from Builder and made the 15% down payment to the builder and 5% for registration. homeloan disbursement is yet to be made.

TDS payment is done for the 15% which is already made to the builder, and still TDS for the 80% of the payment has to be made. but home loan is going be disbursed after 10 Days. can i make Advance TDS payment for the remianing payment (80%) before the home loan disbursement is done by the bank.

thanks

Hi,

I booked a flat cost 50+ L with co owner with my wife in down payment. I did 95% payment to builder in a duration of single month. Basis of above i have following query

1. Can i pay 1 % tds on whole property price at time of possession which is Dec 2014? How much is late payment in that case?

2. Can i pay 1 % tds of 95 % payment before 7 July and submit the form 16b to builder to urjest the TDS amount in final 5% payment?

3. Since there is 2 buyer me and wife and 1 seller builder, Do i have 2 fill 2 separate 26QB form with half flat cost amount still all money paid form my account?

4. Since TDS need to pay in a financial year. Is it not good to pay 1% TDS at final payment at possession time before 31 march if you get the possession before 31 march ?

I have paid 40000 as TDS for a flat purchased. Now while filling IT returns online on e-filling website that 40000 is being shown as advance tax paid & displayed as refund to me. Other TDS on my salaried income is correct as per my Form 16 & on the site. Am i missing something while filling IT returns?

hi, recently we sold our flat for 50+ lacs. the buyer applied for loan while disbursement bank deduted TDS amount and handed over remaining payment on 4-5th June 2014. its almost 25 days now and buyer has not provided us TDS certificate and in 4 days we have to give possession. in such case what can we do? can we refuse possession till TDS certificate is provided?.

Hi,

Can you please let me know how the TDS paid by us is decared in the IT Return forms, currently the TDS paid is coming in the “Advanced tax paid ” section of my ITR, this would mean it would get refunded !!

Thanks

Sir

Thank you for the detailed information regarding this topic. But I have one query.

Sir, due date of payment of TDS as per form 26QB was 17/06/2014 (payment was not made immediately after submitting the form rather option for making payment on subsequent date was chosen) but unfortunately we failed to deposit the same on time. So do we need to make the payment now for that same form using acknowledgement number or we need to file a new form 26QB?

I need to confirm the same as the amount of TDS to be deposited is Rs.7,50,000/-.

Please reply soon.

Thank you

I have purchased under construction flat from Builder and on every instalment, the TDS was deposited. In the ITR, where I have to show this TDS.

Roshan

Hello Ankur,

Thanks to the detailed and clear procedure. I have purchased a property of 5288000 on 01-Feb-2014 (Agreement date). I will get possession in Mar next year. So I am still paying installments.

Due to some reasons I am not able to pay TDS. So it is still pending from my side.

My question is Do I need to pay any penalty for this ?

If Yes, What will be the interest rate?

@SS: Penalty – yes, since you are long overdue.

For current interest rate on penalty, check with a CA.

Hi Ankur,

Need some help, i have not paid TDS for 3-4 instalment payments made to the builder from June onwards ( under construction property).

1. I have to pay now, so what is the penalty ?

2.The builder will refund the same as agreement to sale with builder was executed before 1st June and will he have any issues as financial year is over , pl share your views ?

3. Also i would like to connect with you as i work in this industry and found your blog very useful, would like to connect for business, inbox me your handphone, if keen.

thanks

Hello,

I purchased a flat from a person for Rs. 90 Lakhs. I paid the TDS also online. Now the only problem I have is that I had filed the TDS under others in place of basic tax. Due to this the seller is not able to see the TDS amount which is paid. For him to file his returns this has to appear. I am unable to correct it online using traces web-site as I don’t get the option to correct it while downloading the form 16b. It just allows downloading of form 16b. Whatever options they are telling is available in the tutorial is not showing up. Any idea how to change it or if I am missing something. Any information in this regard is highly appreciated.

I am buying an apartment from a NRI/PIO (owner) who has surrendered Indian Passport but still has the Indian PAN card. The apartment is an allotment to the current owner and it is not yet registered in his name. Now, I assume TDS I need to deduct for this purchase is 20% instead of 1% unless the Owner reinvests the income again in certain areas in India. The owner is asking me to deduct only TDS of 1% as they will provide a declaration/ affidavit on his commitment on reinvesting the income. Can someone confirm whether just an affidavit will work or what shall be the correct TDS/ process to submit it?

Thanks in advance

Hello,

I bought the property and total consideartion is 64 lacs. There are 2 sellers and one buyer. I understand that I have to fill up two 26QB forms. my question is what would be the Total value of consideration (Propery Value ) under Property detail section in both the forms

I assume –

Form1 – 26QB for seller 1

Total value of consideration (Propery Value ) – 64 Lacs

Amount Paid/Credited – 32 Lacs

Form2 – 26QB for seller 2

Total value of consideration (Propery Value ) – 64 Lacs

Please confirm.

Thanks andregards

Amount Paid/Credited – 32 Lacs

@Hari: Looks fine.

Hi,

I have paid the TDS online from HDFC Bank and registered on TRACES. But I don’t see option download form 16. Please suggest

Praveen

Hello,

Thank you for the detailed way to pay the TDS. When is this to be paid?

Is it at the time of booking the property. I have made the 20% down payment end of May. The builder is saying I need to make the TDS for the entire consideration amount (including loan component etc) now and submit the hardcopy before property registration. Is this correct? Should the TDS not be done when/after the registration when I actually make the entire payment?

Thank you & Regards

@Rao: You need to pay TDS only on the amount which you have paid to builder. You need not pay TDS on the whole consideration amount now itself.

Dear Ankur,

I had booked a flat few months back and paid TDS as well for the same. Now, I was about to file ITR for the year but realized that TDS deducted at that point of time is coming as Self Assessment Tax in the ITR as default. However, this is not corresponding to any income earned by me and this tax is coming as extra tax paid which is not the case. Is it fine if I delete this row (ITR form provides the option to delete any row) before submitting ITR.

Thank you

@MS: To me, it looks like you did some mistake while filling up the form.

Since you are the buyer, your TDS data should show up at “PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property)” under Form 26AS on Traces.

I would strongly suggest you to check with a CA before doing any such things yourself.

In my case, FORM 26 AS shows TDS amount deducted for purchase of property under PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property)..But in ITR return utility from income tax site, this amount reflected automatically under self/advance tax assesment..Should i keep it or delete that record?

Thanks for sharing such a good document.

I am also facing the same problem while filling my ITR online. The TDS amount deducted by me came as refund. There must be some workaround for this. Is there any idea how to deal with this?

i & my wife (2 buyers) have purchased a flat(from one seller) for Rs. 58 lakhs. The tds amount is 58,000/- I will hv to submit 2 form 26QB i.e. one each for me and my wife. what should be the property value to be shown. whether 29 lakhs for each of us. Kindly confirm

Hi Ankur,

I was unable to complete my remittance through SBI due to their server issue. Would appreciate if you could tell me if i could use the same acknowledgement number to pay the TDS through SBI on a later date. If so, which window do i refer to in the website. Also, i had mentioned today’s date in the TDS remittance form: would this be a problem at a later stage?

Warm regards

Nandakumar

Hi Ankur,

I sold a property in Ghaziabad in 2011 December for a sale agreement of about 13 lakhs. I am living in New Zealand for a long time as NZ citizen and an Overseas Citizen of India. I have recently received an IT notice asking for info regarding filing of return for financial year 2011-12 relevant to assessment year 2012-13 and any acknowledgement no and proof.

It has also asked for computations of capital gains .

Kindly advise me how to fill the past returns and pay the capital gains on line if possible. I have been told that form 26QB need not to be filled since below 50lakhs.

Regards

Kaushik

Auckland

Hi,

I have paid TDS (for property) of Rs X on 31 march 2013 . So while filing the return online , Rs X is showing as advance tax paid and the same is considered as an excess amount for refund. How to balance the ITR1 form for the tax paid through salary and TDS amount paid. Or is there any other ITR form for TDS payment made.?.

Regards,

Mani

Hi..

Myself and my father have brought a flat for Rs.10000000/- with one Seller. I shall get the possession of the flat in 2017. So i will have to pay 1% TDS and 2 forms for 2 buyers right.

PL help me in where we have to enter the share % in the form for 2 buyer ie 99% and 1% respectively in the form 26QB

And the Value of 1%(Rs.100000) will be share as 0.99%(Rs.99000) and 0.01% (Rs.1000)respectively.

Thanks

Murali

Dear Ankur,

I have filled the form 26QB for TDS and completed the transaction via net banking facility now my query is i dint take the print of form 26QB for reference nor did i save the same but i have the acknowledgement number noted. I dint take print or save 26QB as after completing the payment process the receipt will be generated and i do have the transaction generated receipt.

Now my CA is in need of form 26QB for the same transaction,Can you please guide me now if i can take print of same form 26QB for which i paid the TDS.

My other query is it mandatory to download the form 16b?

Please guide

>>is it mandatory to download the form 16b?

Yes. Your seller/builder will demand that from you.

Dear Ankur,

I am buying a property and the transaction/registration date is 17th June. I will necessarily have to deduct TDS on or after the transaction date, right? Hope we dont have to submit the form to seller on the registration date? Hoping there should be no problems in registration as we are paying through a bank loan.

Also, the property is jointly in the name of me and my wife and payment is going through our joint account. Hope filling one 26QB should be fine in our case? The seller is a company who has two directors.

Your feedback will be greatly appreciated.

Regards, Tarun

@Tarun: If property is in the joint name, you need to fill a form each, irrespective of the fact that you have a common account.

Hi Ankur

I have paid the TDS and have form 26QB, but seem to have misplaced the challan no. Is there any place I can get the challan no. from? IWithout that I cannot download Form 16b

Hi Ankur,

A joint property, in which I was also a co-owner, was sold last August, and the buyer has deducted & paid TDS and issued the certificate for everyone of us. Though, I’ve accounted the my share of property under HUF already, I’ve given my Individual PAN Number instead of HUF PAN by mistake. I’ve also reinvested a major portion of my share of money and have accounted the transaction under my HUF. Can I get the existing PAN number in certificate for me changed to my HUF PAN? The bank that has received payment says that it can not help, as they don’t file the return on TDS for Property sale.

Please, let me know how I can resolve my problem. Thanks!

Hi Ankur,

Thanks to your detailed procedure and informative comments, I managed to complete the 26QB and make the first TDS payment . Appreciate if you could clear the following remaining doubts.

1. I completed the first single TDS payment on 23rd May. Part of the payment to the builder was made on 13 May, but since i was leaving Town the same day, I managed to get the balance payment cheques delivered to the builder only on 31st May. But the date of payment to seller and TDS in 26 QB were entered as 23 May . Will this pose any issue in future. Is there need for a corrrection

2. Is there a Maximum time limit (Maximum) for downloading form 16B. OR can it be downloaded even a month after paying TDS . As I am often travelling , my builders office tried to download it for me on 31st May but said its still not available on traces.

3. If a payment is made ( cheque is issued ) on 3oth June does it mean the last date for the TDS payment is 7th July.

Thanks in advance .

@adam: 1. It shouldn’t.

2. I would suggest you to download it as soon as you possibly can. Normally it is available after 5-7 days of filing Form 26QB

3. Yes.

Hi,

Thank you for this great blog.

I am buying a property in resale from an individual. He wants tax to be deducted before signing the agreement. The challenge is that I can pay the TDS only on the date of agreement. So even if I pay TDS on the date of agreement, what do I show him as a proof that I have made the payment as form 16B is available only after 4-7 days of payment?

Thanks,

Vineet

@Vineet: You can show him the online receipt of payment alongwith Form 26QB.

sir, if the tds payment was late, then what is the interest if no TDS deducted on payment but recoverable. also tell about the fee column.

hi ,

I submitted the TDS on property as 1 % of the total cost via online . but when i am seeing TDS deposited in form 26AS form as 0.0 under section “PART F – Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property)” . Please suggest us how to correct it.

I tried to contact on tps website but thay are simply saying we have no way to correct it there is no online solution to correct it. Please suggest me how can i get rid of this problem.

Hi ankur

i have query – i paid TDS on immovable property before generating form 26QB by challan no 280. Afterwards i filled Form 26QB online and i select subsequent payment because i already paid TDS on property. Then i login to TRACES for downloading Form 16B but it shows message that “No data available for the specified search criteria”.

Please suggest what procedure to be followed in future.

@Tejas: I didn’t understand, how were you able to pay TDS on property without filling Form 26QB? As far as I know, that is the only form available for filing TDS on property.

Hi Ankur

Thanks for all the helpful info above, we are two buyers, who have jointly baught a property from one seller, but have already filed the entire tds amount under one pan no. Of one of us….. is that a problem

If it is how can I rectify it…

Hi Ankur,

First of all Thank you for sharing such a informative article.

Recently, I bought a flat for Rs. 55 Lakhs and my builder asked me to deduct 1% of the amount to pay the TDS. He gave me your link for the steps to followed. I have paid the TDS and got the “Form 26QB”. I am currently out of India and I am unable to access TRACES or download form 16 B.

Could you please let me know whether I can download form 16 B after 3 months when I will come to India or should I download it now itself? Please suggest.

Thanks in advance.

Regards,

Kazim

@Kazim: Which builder is that? I should get at-least a unit from him for doing free service 🙂 On a serious note, Coming to your question, why can’t you download the form from your Traces account from outside India? In case, the site doesn’t open from your country, try the proxy service I have mentioned in the post above. I would suggest you to do it now itself.

Hi Ankur,

I am buying a property worth 86 Lacs where the number of buyers are 2 and sellers are 3. If I have understood your concept correctly, I need to divide this 86 lacs by 6 and fill this form 6 times with an amount of 14.33. Please correct me if i am wrong.

The other thing that i wanted to ask is that the bank will disburse their amount after 15 days. Now should I be paying TDS for that 60 lacs now or after the disbursement. Need to make payment today itself so a quick revert will be highly appreciated. thanks in advance

@Jai: 1. Divide the TDS amount by 6.

2. Pay TDS after disbursement.

Hi Ankur,

I scrolled through all the questions-answers above. Great work but still a doubt persist in my case.

I have bought a flat whose actual price was 57,05,000(circle rate wise) but the total cost on which the deal was made is 46,00,00. Now we are two owners and single builder.

My question is should we pay the TDS on 46,00,000(total cost of the property to us) or 57,05,000 (actual circle rate wise cost of the property).??

Further we took a loan of Rs 32,50,000 from LIC HFL and paid the remaining cash 14,50,000 from our side.

I am sure that we both (dad and me) have to pay half of total TDS each via two forms. But do we need to pay the TDS on 14,50,000 (i.e 14500) or 46,00,000(i.e. 46000) or 57,05,000(57050) ???

Hoping for your reply as it will solve our problem !!

Regards

@Ronit: TDS liability will only occur if your total payment is more than Rs 50L. If it does, you would need to deduct 1% TDS on the complete amount as mentioned in the example above.

Hi Ankur.

Thanks for writing this…its extremely helpful.

1) Could you please tell me if this is to be done for a flat booked before June 2013? I booked the flat in 2010, so would I need to do this when I am paying my current installment in May 2014?

2) Is this to be done before or after asking the bank (from which I have availed home loan) for the disbursement of the installment amount?

3) Also do I ask the bank for 99% of the installment amount? If I ask for the full amount and pay 1% TDS wouldn’t that mean the builder is getting extra?

Would be grateful if you could clarify these queries.

@AAshish:

1. Yes.

2. Once the amount is disbursed.

3. No, builder is not getting anything extra. Ask the bank for 99% and deposut 1% as TDS.

Hi Ankur

Thanks for your reply. Just on #3… currently the bank has sanctioned a term loan of 80%, so for every installment my SB account is deducted for my 20% share and the bank gives me a cheque for the whole amount.

So for example if the demand is for 4 lakhs – This means the bank’s contribution is 3,20,000 and mine is 80,000 (if there were no TDS).

But, TDS is 4,000; this means the bank would give me a cheque for 3,96,000. Would you know how this would be split i.e. how much would be my contribution and how much the bank’s? Would the bank’s contribution be 3,16,800 (i.e. 80% of the demand less TDS)? This would mean I am contributing 20% + the entire TDS amount.

@AAshish: Try to keep it simple. Either ask the bank to disburse the complete 80% amount and you deduct the relevant TDS OR vice versa.

Dear Ankur,

I filled TDS and after 3 working days i was able to successfully login to traces website.

I was also able to see the option for downloading of Form 16 B.

But when I gave the the information there I got error ” no data available”.

Can you please let me know how more days I should wait for applying for downlaod of Form 16 B on traces website and after applying for download after how much time it gets generated

As my Owner is not giving me possession without that.

Thanks,

Ashish

@Ashish: Wait for 5-8 business days.

Sir,

Can I pay TDS on property on behalf of my client who has given the amount to me from my HDFC Account. Is there any issue with the same. Kindly advise.

@Sushanth: I don’t think there should be an issue.

Thank You Sir. Do you advise me to receive payment from my client through cheque ?

Sir I have a property worth 54 lacs and have been paying TDS @1% regularly. What is at the end of the financial year when the time comes to file ITR, can I adjust that TDS amount against my tax liability or can I claim its refund?

Dear Ankur,

Indeed a nice informative article. cleared many of my doubts.

I am making payment to a Builder for a flat , who is a Company . As the TDS is with reference to the seller should I not choose the following option as tax applicable ?

(0020)INCOME-TAX ON COMPANIES (CORPORATION TAX)

where as in you article in the challan you have mentioned to choose the following option

(0021)INCOME-TAX (OTHER THAN COMPANIES)

Please clarify as I am about to make an installment payment.

Thank you in advance.

If you are a company choose 0020 , if you are an individual choose 0021. Since most of the people are paying as an individual hence the option in image above.

Hi Dear,

Please help i have filled for 26 QB twice but seller is not getting the credit all inputs are fine.

When it does to the bank site. It asks for few payment options is it income tax or corporate tax or others.

I have filled others. What is the correct option and is there a process to get this corrected.3

Nikhil Vohra

I have booked an office in joint name with my wife(she is the first applicant and I am joint applicant). Now TDS deduction has to be done by both or only the first applicant?. Secondly, total consideration amount is 62L of which 50% has been paid in April through 4 -5 online transfers from dates 10th april to 28th april. Do we need to fill separate forms for each transfer or only one form for the total 31 lakh paid. Finally, what would be the interest liability as the tax has not been paid before 7th May.

Thanks in advance,

Sagar

Sir i made the payment of TDS on Property in 26Qb Sucessfully , of Rs.57,65,000/- 1% of Total value 57650/- ,but one thing i mistake in 26QB the “Date of Payment/Credit” which was before my payment date as per agreement ,now please told me what to do ? and how i correct my actual date which was 21.10.2013 instead of 21.06.2013 .please give me sum answer .

Hi Ankur,

We purchased a property in 2013, paid the token of 1 lac in May’13, 2 amounts in Jul’13 and the rest of the payment split in Aug’13 and Sep’13. Paid the TDS on 05th Sept for the entire amount together, and as 1 seller though the property is in the name of my husband and mine. my questions are:

*Is this ok?

*As this thing of TDS was started in Jun’13, should we have not deducted the TDS for the amount of 1 lac paid in May’13?

*Though the amount was paid in installments to the seller, made only one 26QB for.

Please advise.

My question is if the property seller is NRI and dont have a pan card, how can be tds deposited ???

@Vijay: I think if the seller is an NRI not having any income in India, TDS will not be deducted. To be sure, conform with a CA.

Hi Ankur,

You have published a Fantastic article which is extremely helpful.

Need your advice here. I have just bought a flat worth 1Cr, which is jointly owned by Husband and Wife.

Should I pay the 1 Lacs of TDS in only the husband’s name, or do I pay 50K TDS in husband’s name and 50K in Wife name.?

Also the property will be jointly owned by myself and my wife, so while that increase complication to 4 TDS..? 2 from me to both sellers, and 2 from my wife to both Sellers..?

Thanks in advance.

Amit.

@Amit: 1. In both names.

2. Yes rightly said, 4 forms.

Hi Ankur,

I have received the challan after submitting the Form 26QB. Can you tell me whether the amount need to pay under the head of “Income Tax” or under the head of “Others”.

Also on challan i did not find any information related seller, where can i found the it.

after getting registered as a new user traces asks to login again so what password should be entered there..???

@hina: Your traces password.

but sir while registering it does not asks for proving password nor it provides by it own… and can anything be done to download form 16b in case we have missed our acknowledgement no. …

Hi Mr Jain, About 3 months back we sold a flat for 85 lacs. The flat was jointly owned by my wife and self. We are both NRIs and don’t have any income in India. It was a sole purchaser. In the title deed it shows payment of 85000 TDS deducted from price. The purchaser is not supplying the certificate to me to enable me to ask for tax refund. How can I claim tax refund from the tax department in the absense of the certificate. I can not chase the purchaser directly as we are abroad.

Please advise.

Regards

Ashis

@Ashis: There is no reason why your purchaser is holding the certificate with him.

i have made the payment through net banking for “Form 26QB” on 11th may 2014. now i have pay the TDS for builder.

i have Challan sr no. with me and the amt paid. as suggested i had to pay after 3 days as there is some updation, which takes time. where to see that and how to go ahead after this

pls let me know the step wise process for the same.

dear sir

kindly guide, my husband and me together own a property which is being sold at 1.29cr to single buyer. kindly guide us how to pay and what and how many forms to be filled. since we are two owners how to receive money visa vis tax. thanks

@Anita: TDS has to be deposited by buyer and not seller of a property.

hi, my brother and myself are buying a property from a SINGLE owner and whole price is 70L. but we both are going for two different sale deeds..i.e 40L and 30L each. we are not doing joint registration. Since the seller is same, should we have to pay the TDS?

@Srikanth: I’m not sure if this is possible to have two diff sale deeds for a single property.

Hi Ankur,

Thanks for such detailed guidelines and your answers to the queries which resolved most of the queries. I have purchased a flat @63 lakhs on resale. Two buyers including his wife and two sellers including my wife. 61 lakhs was paid to his account and 2 lakhs to his wife’s account. We have taken a loan from SBI with 50% share. As understood from your write up and earlier communications, four 26QB form has to be filled up. Tax to be divided in proportions of the payment to the accounts (61:2) and our share (50:50). The ‘Total value for consideration’ should be 63L or the proportionate values?

Hi Ankur,

First of all, its a very informative article. Thanks for providing this service to the society!

We bought a property on construction linked plan under my and my husband’s name. So there are two buyers and one seller. However, my husband has been making all the payments from his account. Now when we filled up the form we did mention 2 buyers but it did not direct us to fill 2 forms. So we submitted just one form. However, we haven’t made the payment yet from the bank account. Please advise if we need to fill up the form again (2 forms) or rather can we fill up the form again?

Also, while filling up the form last night I could not access the bank’s website to pay online. Is there a way I can use the same reference number and pay at my bank’s website? I do not see that option anywhere. I did not even mentiona n email aid in the form since for some reason, it kept giving me the error with that email id.

Looking forward to your reply. Thanks a lot!

Thanks,

Pooja

Dear Sir

I am planning to purchases Flat . Total Sales consideration is 60 Lakhs .

My Query –

Seller Registration was Jointly with his Brother but Brother ratio is zero . I have added My Wife name for co- applicant without any ratio.

I will pay money in first name only .

Should I generate one TDS form for 1% of 60 Lakhs.

Thanks

Ashok

Please let me know when the TDS to be deposited, after the sale is registered or before.

@Maya: After.

Hi Ankur,

Very useful information and thanks for taking the time to reply to all queries.

I have bought an apartment (worth 80L excluding regn, water elec charges, service tax etc) on an assignment agreement. Out of that, say 40L is payable to the assignor and the remaining to the builder. The amount to the assignor is payable in one shot, and to the builder in installments as per stage of contruction.

Question is – do I have to deduct 1% TDS each from both the assignor portion and the builder portion ?

Regards

Debajyoti

@Debajyoti: Yes.

thanks sir,. for the information.sir i want to ask is there any procedure to get back the challan amount

Respected sir ,if any mistake happen while filling this 26qb form and the challan is confirmd how one can get it corrected

@Sakshi: Contact IT office with complete details. They have a contact link on the same website.

I bought an apartment last year in August-2013 for around 60 lacs and recently paid the 1% TDS tax using FORM26QB from TIN-NSDL site and everything went fine.My FORM-26AS is showing correctly in Traces Website and it has the correct entries for the TDS on property tax paid. But I am unable to see the option to download FORM-16B from Traces Website. I am based in USA currently and using the NRI version of traces website(https://nriservices.tdscpc.gov.in/nriapp/login.xhtml).

Is anyone else seeing this issue and know how to tackle this issue on how to download FORM 16B?

Thanks in advance!

@S Mittal: It takes around 6-8 days for the payment to reflect in Traces.

I have purchased an under-construction property in Re-sale from 1st seller for Rs. 53 L. Please consider the scenario below :-

1) I have to give 33L 51 thousand to the seller.

1) I gave toke amount of Rs 5L in CHEQUE, which was cleared on 2nd April 14.

(1) On date of signing Agreement to Sell( (5th Apr’14), I gave the seller a cheque for Rs. 20 L. The cheque got cleared few days later.

(3) For remaining amount, Rs. 8 L, I applied for home loan which was disbursed on 1st May’14.

4) Also paid the last balance of 17 thousand on 9th May 14.

Me and my wife are the buyer of the property but, my wife is a housewife. The seller is only one.

Now please answer the below questions :-

(2) In how many parts TDS should be paid ?

(4) How many 26QB forms should I fill ? Since my wife is a housewife, I am the only breadwinner, so ideally I should fill only one form in my name.

(5) Should DD disbursement date be the date OR it should be the date when I gave the DD to seller??

Awaiting a prompt and positive response from you.

Thanks

@Jai: Please check comments above, most of your questions are answered already. As far as TDS is concerned, for the 3rd party seller, you can pay the TDS in one go.

Dear Sir

I filed for 26qb and then eventually for a registration done on May 2 but both mention the date of payment as June 1,2013 in one column bu the tax credited date april 30th is also reflected correctly should I leave it as it is or change the date

Very informative. Great article.

My query is i am buying a under construction apartment in resale where payment is construction linked.

On the day of transfer i will be paying 50 lacs to seller and another 60 (outstanding + fresh demand) to the builder, funded via loan from SBI.

My query is – how do i handle it from the 1% TDS perspective?

Do i mention it as 2 sellers? Also am i expected to cut 1% in all future installations i pay to the builder in future as and when the demand comes.

>>Do i mention it as 2 sellers?

No. Right now you are purchasing from a single seller. You need to deduct TDS in his name for the amount you give to him. Post that, you will be dealing directly with the builder and hence you would need to deduct TDS in builder’s name.

>>Also am i expected to cut 1% in all future installations i pay to the builder in future as and when the demand comes.

Yes, you need to deduct for all instalments if the total value of property is more than Rs 50L.

Hi Ankur,

Will filing Form 26QB,I made a mistake and entered buyers details in place of seller and seller’s details in place of buyer.Can you tell me how to rectify this mistake since even my CA is not aware about this issue.

Also while filing the form I was not aware that for 2 buyers and 1 seller i need to fill 2 separate forms.It would be really helpful of you if you can answer my query or guide me in correcting my mistake.

Thanks

@Shivang: Please use the Contact US link of IT dept and let them know the complete issue.

Also this property was bought by me and my wife (as co applicant).. however my wife is neither an earning member nor is she a tax payee or PAN card holder.. all the payments have been made through my account only. Do i need to fill in 2 forms ( 26QB) or single form would do ?

i have entered into sale agreement with a builder 3 years back and have been paying Construction linked Installments through my ‘HomLoan Co’ to the Builder as per the Demand raised. There is an instalment due in end May and the ‘Homeloan Co’ has confirmed that they will make the payment to Builder after deducting 1% (TDS). However there was one installment paid in Oct’13 (i.e later to 1st June’13) and at that time the ‘Home loan Co’ had not deducted the TDS and made the entire payment. Please clarify if the TDS with intrest is to be paid by me for that installment and produce the Form 16 B to claim refund from Builder ?

@Jai: Check with builder. I am sure if they are professional, they will understand the issue.

Hi Ankur,

I see lot of valuable information , Thanks a lot for putting this up. My query is –

I purchased flat and agreement value is 50,20,800. and service tax is 3.09% which comes out to be 155143. As on date 55% demand is generated which comes to be 27,61,440 and Service tax 85327. – Property is on my wife name and I am co-owner (done for Tax benifit)

I understand I have to pay 0.5% each (me and my wife ) on paid up amount and submit two 26qb, What If I pay tax for all amount at once ? I see there are lot many future milestone of 5 % each from bulider and it would mean I will end up paying 20 (10 *2) 26 QB.. Please let me know if that can be done legally if not logically?

@Santosh: I would suggest you to take the pain and submit it in sequence. You can semi-automate the process using tools like Roboform

Hi Ankur,

I filled up from 26QB, paid the amount and got my challan #. After few days I register with the same challan #. When i try to download From 16B with all the required information it gives me error “No data available for the specified search criteria”. I am not sure why it is giving the error.

I would really appreciate your help. Hope to hear soon from you

Hi,

I filled my form on Wednesday and my Form 16B got generated on Monday. Hence, not sure how many days you have waited. It used to take couple of days for generating this.

Regards,

Tarun

Dear Ankur,

i deposited 3 installment to builder without deducting TDs,in financial year 2013-14 and now i m deducting and depositing tds what should be financial year in 26qb form

@Dr Himanshu: You would need to pay the interest for TDS not paid for earlier instalments. Financial year would be 2014-2015 and assessment year would be 2015-2016.

I have made a 4 mistake while filling the form 26 QB online by selecting

1) FY 2013-14 instead of 2014-15 in

2) AY 2014- 15 instead of it actually being 2015-16

3) Date of payment credit & date of tax deduction both as 01 June 2013 as it was changing at tat time & i thought it should be the date when this tds rule came in force which is 1st june 2013 ,but the date of aggreement for sale, payment date &demand draft date which was 03 April 2014 which i did type in correctly. I went ahead with the payment through my bank not realizing the mistakes i have made till i was alerted by the seller after 10 days & now i am in a fix as the seller has refused to give possession of the said flat & sign on the transfer documents till the time i d0nt correct the mistakes i have done because he says he is having trouble with filling his I.tax this year due to my mistakes. PLZ help me on the issue with the procedure as to how i can go about with rectifing these corrections. thanks await a reply asap

@menino: Email the folks at Traces/IT dept, detailing them about your issue. May be they can help.

I filled in the form, confirmed on page, proceeded to bank website, and it gives me incorrect page to login assuming I am a corporate user even after selecting 2nd option for other income tax. I have lost the login page now, can i just make a net payment from my bank account online ?

but where do i make the payment?

account details?

or do i have to fill the form again?

Hi Ankur

I paid the TDS via 26QB form and the amount also got deducted form the bank a couple of weeks back.

I do have the E-tax Acknowledgement number and OLTAS transaction Reference number.

However, I did not get any challan number

Now when I try to register on TRACES, it asks for Challan number which I dont have

What should I do?

Thanks

Tejas

Wonderful article with good information.

I recently bought a flat from NRI for 70 lakh and it has been agreed to deduct TDS@ 20.6% amount 14.42 lakh.My query is which challan should be used for TDs where seller is an NRI

Dear Ankurji,

I have buy flat worth rs 52 lakhs for which agreement is done in th month of august. that we were not aware about deduction of TDS and builder also not advised the same. so just want to confirm is there any interest is applicable if we filled TDS now?

also agreement is done with my wife and my name and 100% payment has been made from my account . so shall I paid 100% TDS from my account only?

waiting for your kind reply .

regards

yogesh

@Yogesh: Yes interest is applicable. Ideally there should be two forms.

Thanks for the article Ankur

I have filled the TDS and made a spelling mistake. My building name is Pioneer and I wrote Poineer in from 26. Can you please let me know if that is a problem? If yes then how can I rectify it?

Thanks for your help in Advance.

@Rohan: I suggest to check with a CA but in my personal opinion it shouldn’t be an issue as long as the PAN card no of the builder mentioned by you is correct.

Hi,

Trying to Register in traces But cant seem to get the challan no right. It is not going through

Thanks for very useful information on your website.

You mentioned last date for payment of TDS within seven days of the end of month of payment of the installment. I read somewhere that for the installments paid in the month of March, the last date would be April 30 of that year. Is that right?

@Devender: It is 7th of the next month. So if you make an installement payment in May 2014, you should make the TDS payment by June 7th, 2014.

Dear sir,

My builder says to pay after deducting TDS at 1%.

This value is inclussive of VAT paid to Builder.

For example 20% on booking works out to Rs. 2985920

Vat @ 1% Rs 149296

Builder tells me to pay Rs 2954568/-after TDS of Rs 31352/-

If I go for 1% TDS amount comes to 29859/-

Is it on VAT also we have to deduct TDS?

Ramadorai

@Rama: As fasr as I know Service Tax is included, for VAT check your local CA. Our taxation rules vary from state to state.

I am going to purchase property about Rs.6500000 I ready to pay Rs 65000 now my question is that when i should pay tds before sale deed or after sale deed?

@Vijay: After the payment is made.

Thanks for valuable info.

I have a query that i have the joint proprty in my name as Applicant and my father name as co-applicant. Tha value of property is 7203000. I have made a payment of 353238 in the last FY13-14. Now recently i got the call from my builder to pay the TDS as appliacble 1% in last year’s date. But in from 26QB there is only date of tax dedcution which i filled as 30Mar 2014 but still in the challan copy it appeared as today’s date 26Apr2014. Also, i have filled interest amount as zero so, please let me know if the same is fine i.e filling interest as zero.

Also, as my father is co apllicant so i have taken 200000 as the payment amount for my TDS deduction i.e 2000. However can you please let me know for filling the remaining amount TDS i.e 153238 which is 1532.38, can i use my accoutn to pay the same or he should perform the deposit through his account.

Regards, RK Ahuja

@RK: It is preferable to transact through respective accounts.

If there are two sellers and one seller pan is applied for can tds be paid by purchaser deducting tds @1% from the seller whose pan is availabe.bth sellers are husband wife..

@Sumit: I suggest to wait for the PAN card. This process is new for all of us and you may get into unwanted situations later on. Better to be safe.

1. i am late by 2 months to take form 16B Because i filled form 26 Q in 26 of feb . suggest me now what i have to do.

2. is there any option to pay this in banks or any place directly , because it is very lengthy process.

@Suresh: You may need to pay the amount with interest. I think they do provide option to pay directly in bank.

HI-ANKUR ,

Tnx for your suggestion & now wants to know about 2 doubts i.e.

1. As i wrote i have paid the amt in feb & only form 16 B left to down , so pls suggest i have to pay whole amt with interest or only interest on paid amt .

2. This property is joint property in the name of myself & my wife , But i have paid amt in my name ( 26QB ) only . Is this correct or i have done wrong . Kindly suggest me .

Hi ,

I forgot to note down the Challan number on the last screen. Will I be still able to download the Form 16B.

@Kajal: If you have already created your login, yes. If not, you can check with the Traces folks.

Thanks for the article Ankur.

We bought a property from a developer in 2013. Construction is due to complete in 2015. We paid the full TDS in 2013 itself. Two questions:

1) After paying the TDS we did not download/ fill Form 16B online. (we are NRI and somehow did not know about this form). Can we do it now or do we need to contact the IT department?

2) We plan to sell the property this year itself before construction is completed. Am aware of Capital Gains etc. With regards to the TDS amount paid up, can it be claimed back since we are not taking possession of the property? Or should it just be offset against gains for CGT calculation?

Thanks! Anita

@Anit: I guess this form is not required if you’re an NRI who is not liable to pay taxes in India. Check the comments above.

sir,

i purchases a property worth 81 lakhs . they were total 6 owners each getting equal share of 13lks change .out of the 6 brothers, 4 reside here and 2 are nri . how to calculate tds on nri as we paid 1% tds to 4 people who hold pan card.kindly guide soon

@nikil: Looks like a difficult situation. 6 buyers * 4 sellers = 24 forms! Check with a CA.

Hi Ankur Jain,

Could you please confirm what is the grace period i do have to settle the TDS. If it got delayed for 3 months does this will give create any problem…. please explain…

In my case : I want to confirm that i have 1 seller and 2 buyer property value is 59 Lakh, as per government rules TDS should be paid from seller but he is not ready to bare the charges and asking buyers to bare that cost… how does these will work out… (please note seller is NRI he sold this property with his agent (She is non other than her mother)…….

Please assist what should be done on this…………..

@Faisal: TDS needs to be deposited by the 7th of next month of the payment made. If you’re late simply pay the interest. No worries!

Ankur, Interest ( for delay) at what rate 1% or 1.5% per month? Kindly clarify

Dear Sirs,

The info you have given is very useful and put together very diligently. However I wish you had elaborated a little more on Major Head and Minor Head details called for in 26QB. Where do you find what the Major Head / Minor Head codes nad details. ?

Thanking you

Yours sincerely

SATISH KUMAR K N

@Satish: Which minor/major head are you talking about exactly?

Hi Ankur,

I recently sold a property for INR 54 lakhs on April 8th 2014 and will soon get the TDS details from the buyer.My questions :

I am a salaried person so how do i go about claiming a tax credit of INR 54000/-?

The aforesaid property was bought by me for INR 37.5 Lakhs in May 2010 should how much Capital gains Tax liability is there?

I have booked a flat in Dec 2013 with a builder and total value is approx 1.4 cr ,19.9% (approx 28.5 lakhs) has bee paid but no registration of sale deed has taken place.

Should i be paying the TDS on it now before registration?

Hi Ankur

What is the definition of Total Sales Consideration of a flat (this is required to be filled up in Form 26QB). Does it include Other Charges such is Interest Free Maintenance Deposit, Maintenance Advance and Social Club Subscription.

Should the Total Sales consideration include Service tax also.

Arindam

Hi,

I have recently purchased a flat. Advance payment for the same was made in March 14 and final payment in April 14. Will I need to select different FY for both TDS challans i.e 2013-14 for March payment and 2014-15 for Apr payment

Hi Ankur,

Many thanks for the information provided by you.

I have a query: I have filled form 26QB and deposit in bank (PNB) for offline payment by check in favour of “PNB Account Government Dues” dt on 04 April 2014 but bank did not provide me “Challan Serial Number”.

Could you please advise me on the same

Anuj Jain

Dear Mr Ankur Jain

I have query

We are 2 buyers and 1 seller.We purchased property in 2011 and paid the part payment of rs 10lakh -1st buyer and rs15lakh – second buyer.At that time tds on property was not applicable.now question is do we need to pay the tds on above amt also? If yes how can we pay the tds on the above amt?

thnks

raj

Hi Ankur,

Thanks for the detailed artical on TDS. I have recently purchased a resale flat for 97,25,000/- from individual seller. We are joint owner (My wife as 1st owner and me as 2nd owner). I have made all the payment from my wife’s account. Also we have taken a joint home loan. So want to know whether we need to fill seperate form 26QB for me and my wife by diving TDS amount (i.e. 48,625/- each) or we need to fill only 1 form 26QB for my wife. We both are salaried employee and have PAN details.

Awaiting your reply.

Thanks and Regards,

Yogesh

I am facing problem with Form 16-B generated after payment of TDS. The Form 16-B is showing Rs. 0 in the column “Details of Tax Deducted and Deposited with respect to the deductee” and the amount deducted as TDS is shown in the column “Details of Tax Deposited in the Central Govt. Account through challan”. The seller is not accepting this Form 16-B and insists that the TDS amount should be shown in both these columns.

Please advise where I have gone wrong and what can be done to correct the mistake. I have not kept any copy of Form 26 QB or Challan and CPC/ Traces is not helping without these.

Thanks a lot for the valuable post. I came to know about it bit late. So I already released 4 installments to builder without deducting TDS. When I came to know of it, the builder told me to deduct the 1% from starting and pay now. But I am confused on how to calculate the “Interest” for the late payment.

a) Do I have to pay the TDS per installements (now)? ie 4? (in 1:1 case)

b) How to calculate the Interest in each of the delayed payments? (Say the 1st one I did on 1st of Jan for 10 lakhs).

Thanks again!

I have filled up the form 26QB, submitted and got the Acknowledge number. Then, I clicked on submit to bank button. The HDFC retail option came. when clicked there, I got the error message that “invalid assessment year.” The date of payment was 31-10-2013 and I am trying to pay tax now, in April 2014. Do I need to give 2014-15 as financial year in the form 26qb ? But there was no error while filling form 26qb. This happened repeatedly. Please help me to solve this. I could not remit the tax till now. I used to pay income tax and tds through HDFC bank and there were no such issues. Please advise me friends.

Thanks in advance…

I have bought a property in Navi Mumbai registered in Apr 2013. The total cost is Rs. 5500000.00. Of which I had paid 10 lakhs in April 2013. After 1st June 2013, I paid 40 lakhs more as part of payment in installments. Kindly advise for following:

1. Is TDS on property applicable in my case? (as the rule says property bought after 1st June 2013)

2. TDS if to be paid shall be only on amount paid after 1st June 2013 or total cost of the property?

Sir,

I have purchased a property worth Rs55 lakhs and it has been registered in the name of me and my father. Consideration of Rs 10lakhs has been paid and balance would be payable by home loan. The entire consideration paid/payable is/will be in the name of my father, Also in agreement there is no where mentioned about the share in the property.

So my queries are:

1. Shall i file 2 forms? if yes then how shall i divide(tds will be paid by my fathers account)

2. If i want to make payment of entire TDS can i make it before the bank disburses loan, if yes then how?

Waiting for your responce.

Thank you

Thanks for taking this intiative for amazing write up & knowledge about TDS on property.I am an NRI and have purchased a property worth rupees 70 lacs in DEC 2013 & seek some helps from your side.

1. I have missed out the payment on TDS ON SALE OF PROPERTY by 31st March 2014, now i ‘m trying to make payment by selecting financial year 2013-2014 after filling all details & proceeding further it give me “invalid assesment year” error message what needs to be done?

2. Will there be any fine or interest charges for late payment as i was not sure about TDS payment need to be done from myside.

3. Total payment gone to builder is 80% of 70 lacs, does this mean i need to pay TDS on this 80% of amount or can pay 1% TDS on whole amount of 70 lacs.

HI,

I HAVE FILLED 26 QB AND GENERATED THE SAME AND ALSO NOTED THE NO APPEAR ON THE SITE AFTER THAT WHEN I HAVE CLICKED ON PAYMENT GATEWAY IT SAYS A.Y. NO MATCHED AND GOT ERROR AND EXITED AUTOMATICALLY.

NOW DO NEED TO REFILL THE SAID FORM OR CAN I MAKE PAYMENT DIRECTLY IF I HAVE A REF NO OF 26 QB?

PLEASE EXPLAIN ME THE SAME AND OBLIGE.

Dear Mr Ankur,

Thanks for the well explained article,

Still I need a clarification,

I bought property which has 2 seller and 2 buyer, as per your explanation I need to fill four forms,

what are the combination of buyer seller

is it buyer 1 seller 1 , buyer 1 seller 2, buyer 2 seller 1 ,buyer 2 seller 2? and on each form do we keep the total value same or we divide it into 4 ( for e.g. 80 lack worth property each form total value is shown as 20 lakhs)?and 1% of 20 lakh on each form?

On top of this, as the financial year changed between transactions, if I need to pay TDS in parts, which financial year should be chosen for each such part of TDS ?

I have purchased a property in Re-sale for Rs. 63 L. Please consider the scenario below :-

(1) On date of signing Agreement (24 Feb’14) to Sell, I gave the seller a cheque for Rs. 5 L

(2) After a week of signing Agreement to Sell, I transferred Rs. 20 L into seller account through RTGS.

(3) For remaining amount, Rs. 38 L, I have applied for home loan which is expected to get disbursed in 2nd week of April’14.

Me and my wife are the buyer of the property but, my wife is a housewife. The seller is only one.

Now please answer the below questions :-

(1) What financial year needs to be selected ?

(2) In how many parts TDS should be paid ?

(3) Should I select Installments or Lumpsum payment ?

(4) How many 26QB forms should I fill ? Since my wife is a housewife, I am the only breadwinner, so ideally I should fill only one form in my name.

(5) Since the loan is not disbursed yet, can I make a lumpsum TDS payment of Rs. 63000 on the expected date of disbursement ? Please suggest

Awaiting a prompt and positive response from you.

Thanks

Hi Ankur,

I recently paid a TDS of Rs 45,000 approx via the TIN website & my bank- ICICI.

The challan got generated & when I showed it to the builder there is a strange issue. the builder is saying that he won’t get credit for the same as the amount is showing under the head OTHERS in the challan. As per the builder It should have been INCOME TAX

I do remember going to the online page via internet banking & selecting others as the heading as this was TDS on property & not Income tax .

Builder is asking me to get a refund of the same & pay it again under the correct heading.

would you know if this should be an issue? what would be the process of getting a refund? when i call the TIN website they are asking me to visit nearest Income Tax office & I am scared 🙂

Hello Ankur,

I recently paid a TDS of Rs 51,000 approx via the TIN website & my bank- ICICI.

The challan got generated & when I showed it to the vendor there is a strange issue. The vendor is saying that he won’t get credit for the same as the amount is showing under the head OTHERS in the challan. As per the vendor It should have been INCOME TAX.

I do remember going for online payment page via net banking & I had selected others as the heading as this was TDS on property & not Income tax .

Now Vendor is asking me to get a refund of the same & pay it again under the correct heading.

What should I do? Its the same problem as that of Satya.

Please reply… Thanking you in advance.

Hi, is ur problem resolved?If yes can you share the detail what steps that you have followed.

Awesome, thanks Ankur for all your help

Hi Ankur,

Very good article. I have a question. My fatehr has recently sold a land worth 95L to my sister and brother-in-law who are US citizens and dont have PAN numbers. How do we file the 26QB in this case? If this cannot be done, is their an alternate way by which my father can ful-fill his tax liabilities. He has re-invested the entire amount in an apartment. Appreciate your advise on this.

thanks,

Anand

Hi,

I have purchased property with consideration value of 58,22,327/- Rs. and agreement was done on 20/03/2014. I had already paid 7,00,000/- towards part payment as own contribution and 45,40,145/- from HDFC bank loan to builder. I have single buyer and single seller combination.

1. Can i pay TDS of 1% on complete consideration value beforehand as i have done partial payment to builder?

2. Do i need to pay TDS in current financial yrs only (2013-14) as agreement is done on 20.03.2014?

3. Within how many days i need to pay TDS from agreement value or can i pay TDS before my final disbusement from bank to building for complete consideration amount?

I booked a construction linked apartment costing 100 lacs 20 months ago. Payment of 30 lacs was made before the issue of notification i.e June 1, 2013. Now I have to pay 10 lacs instalment. TDS deducted is to be Rs 10 thousand Kindly clarify

Dear Ankur,

Thanks for the article. I want to know the below things:

1. What is the interest to be paid for late deposit of TDS?

2. Do NRIs need to pay the TDS on Property?

3. When depositing the TDS late, what will be the Date of Tax deduction?

Regards

Amit

Hi Mr.Ankur,

I am about to make payment of 1%TDS for my property (Price on paper Rs.53 lck) . I have already paid entire amount to the builder, so should I put entire amount in “Amount payble to Seller” ?

And , what should I select in “Payment Type” – Installment or Lumpsum ?

Thank you very much in advance ..

Dear Ankur,

I have purchase property on my name 1st nad on my wife’s name 2nd from a company in resale. Agreement value is 10700000/- which i paid over the period of 2 months from my a/c only. Now i have paid 10593000/- to seller in total. TDS of 1% which is 107000/- i have deducted.

Now i have to pay TDS. How many form 26QB to be prepared and of what amount? Is it 50-50% each. And weather it from my a/c i can pay or i have to pay from my wife’s a/c also?

@bhushan: Two 26QB form. Preferably from respective accounts.

The property value is of 50 lakh and 17 lakh has been paid only to the builder as installment in this month . TDS to be paid on installment amount i.e 17,000@17 lakh, is it? is there any due date or time limitation? for remaining amount of the property i.r Rs . 33lakh , TDS has to deducted on installment basis is it so?

@Mann: Yes, if you are paying in instalments.

Yes, given that the total cost of property is more than Rs 50L.

In your case, you may also want to negotiate with your builder to bring it down by Rs 36001 and save this TDS headache 🙂

Thanks for the clearing most of the doubts i had on TDS on property exceeding 50 lakhs.

I have one query: The total cost of my new property is 50,36000 and this month I paid the 2nd installment to the builder which happens to be Rs.779074 on which the builder mentioned to pay Rs 7791 as TDS.

My query is shall I submit only Rs 7791 as of now splitting it into 3 equals as my brother and mother are co-owner with me.

Thanks in advance

@Ahsan: Yes, it would be wise to split the amount into 3 proportions.

Thanks Ankur for the clarification.

So the bottom line is that whatever amount we pay…..we need to deposit the TDS for that much amount only not the whole cost. Correct ?

Dear Sir,

just wanted to know can we pay the full amount of tds at the time of registration of the property or we have to pay at every instalment paid to the builder..

@Vishal: At every stage if the total value of property is more than Rs 50L.

194IA applies to Residents.For non residents the relevant section is 195. Therefore Form 26QB cannot be used in the case of Non residents. There is also a recent circular of CBDT 1/2014 dated 13/01/2014 clarifying that if Service tax is mentioned separately no TDS needs to be deducted on the Stax component.

Sir, I purchase flat costing 1.51cr. I given 32 lac to builder in month of Feb and March, agreement not register.

1. when i have to deposit TDS (before agreement or..)

2. As it is part payment should i clubbed TDS and then submit.

3. What is rule of deposit( time period)

Hi Ankur,